Note: while the examples presented in this article are all from the German-speaking world, the essential aspects should be easily understood through the descriptive text.

The question of “what does the consumer want?” is probably as old as business itself. In the age of almost unlimited purchasing and procurement options, both online and offline, the question is more urgent than ever: does my offer meet the demand (well enough)? Or are there differences or even entire areas of demand for which I am not visible as a supplier, although I could serve them?

In addition to the usual market research tools (such as surveys or panels), there is another, more cost-effective approach in today’s highly digitized world, which we would like to present today.

Google has long since ceased to be (only) concerned with offering a website that is as technically “clean” as possible. Google now decides on the order of search results based on user acceptance. So what does “user acceptance” mean? Basically nothing more than: how is a specific offer (of a product or service) seen, evaluated and accepted (or rejected)? Consequently: how high is the coverage between my offer and the demand, i.e. how much can I meet the expectations and wishes of the users (and potential customers)?

Google sees itself and works as a “moderator”, and therefore always strives to match the behavior of its users. In other words, Google tries to provide the most suitable answer possible to a user’s search/question. In other words: to achieve the highest possible coverage of supply and demand. Through this role as moderator, many aspects about the expectation and acceptance of specific target groups can be uncovered, and not only statically, but also over time: does the expectation and/or acceptance change? If so, in which direction? How should I react to this?

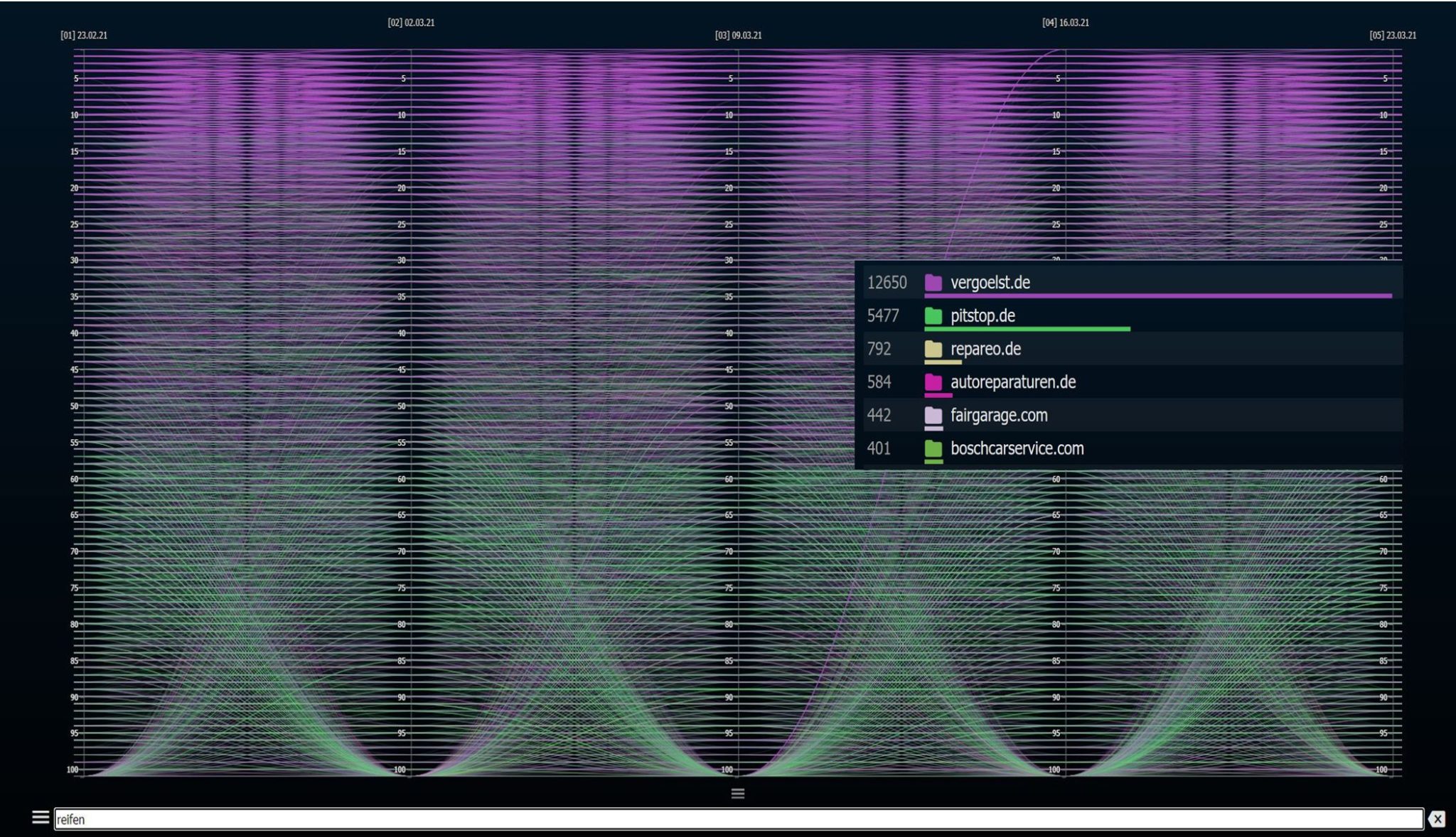

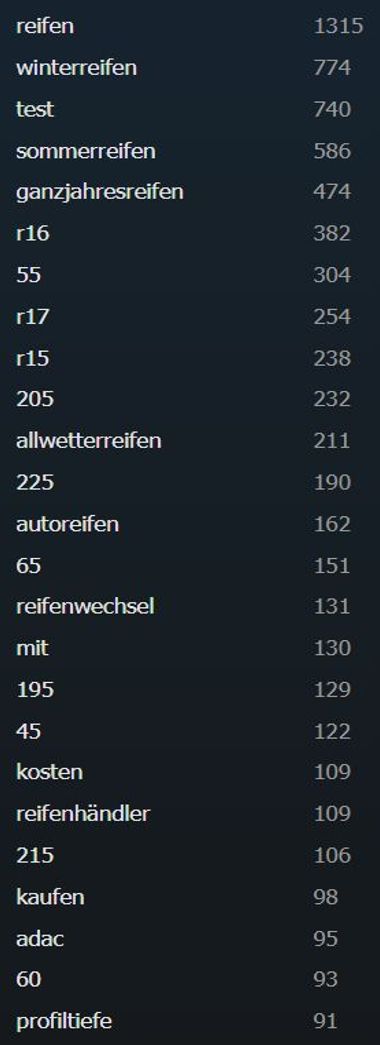

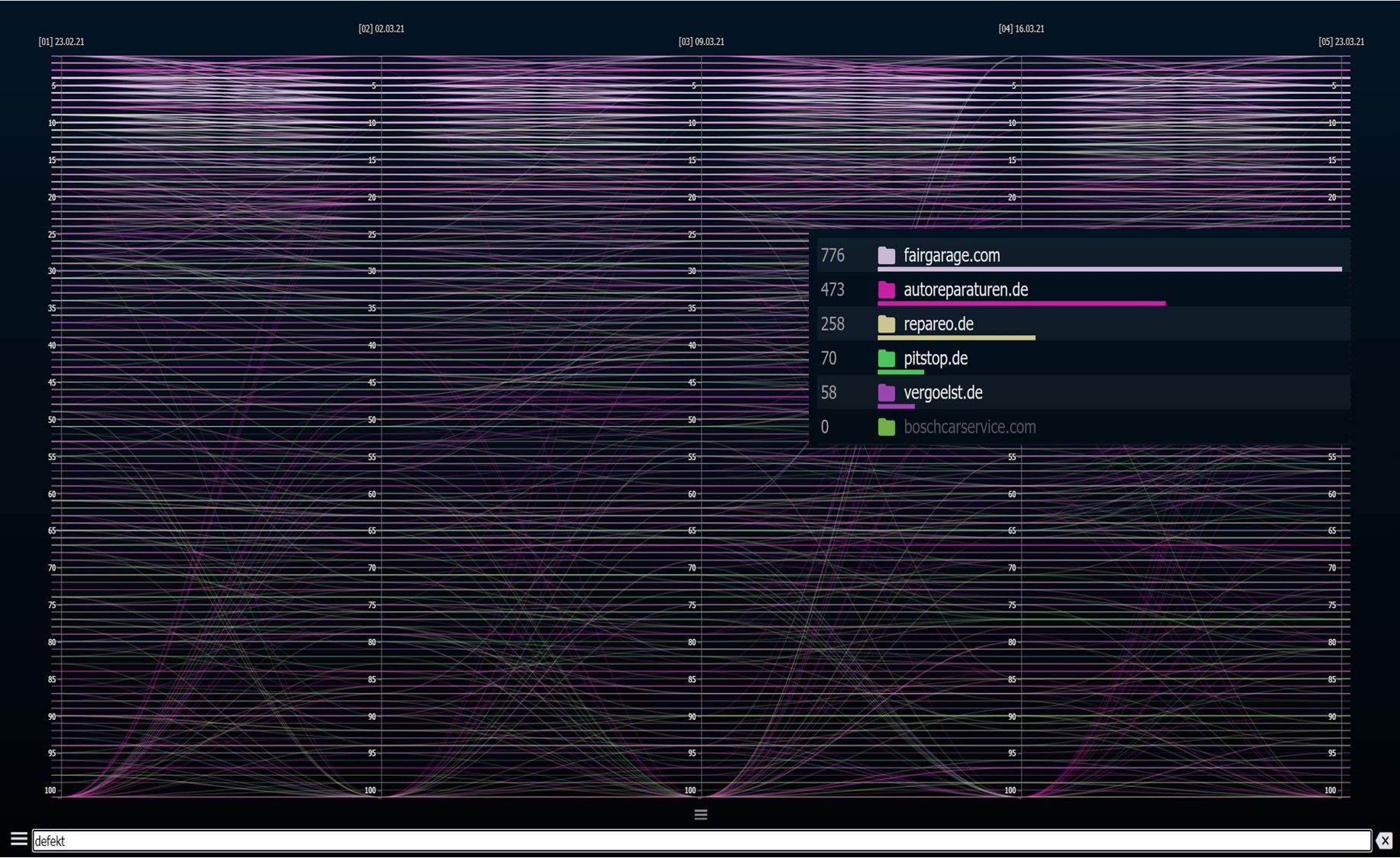

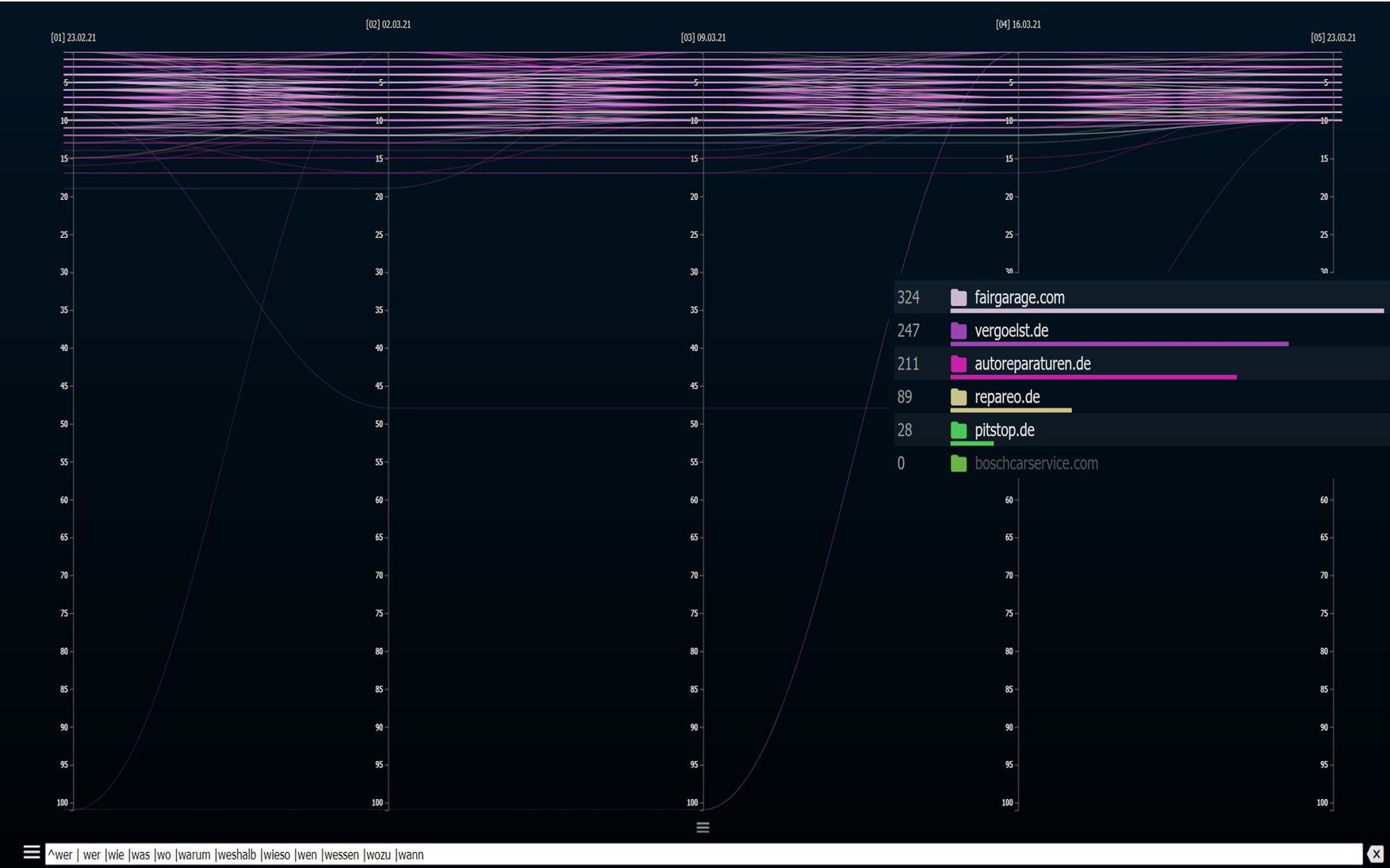

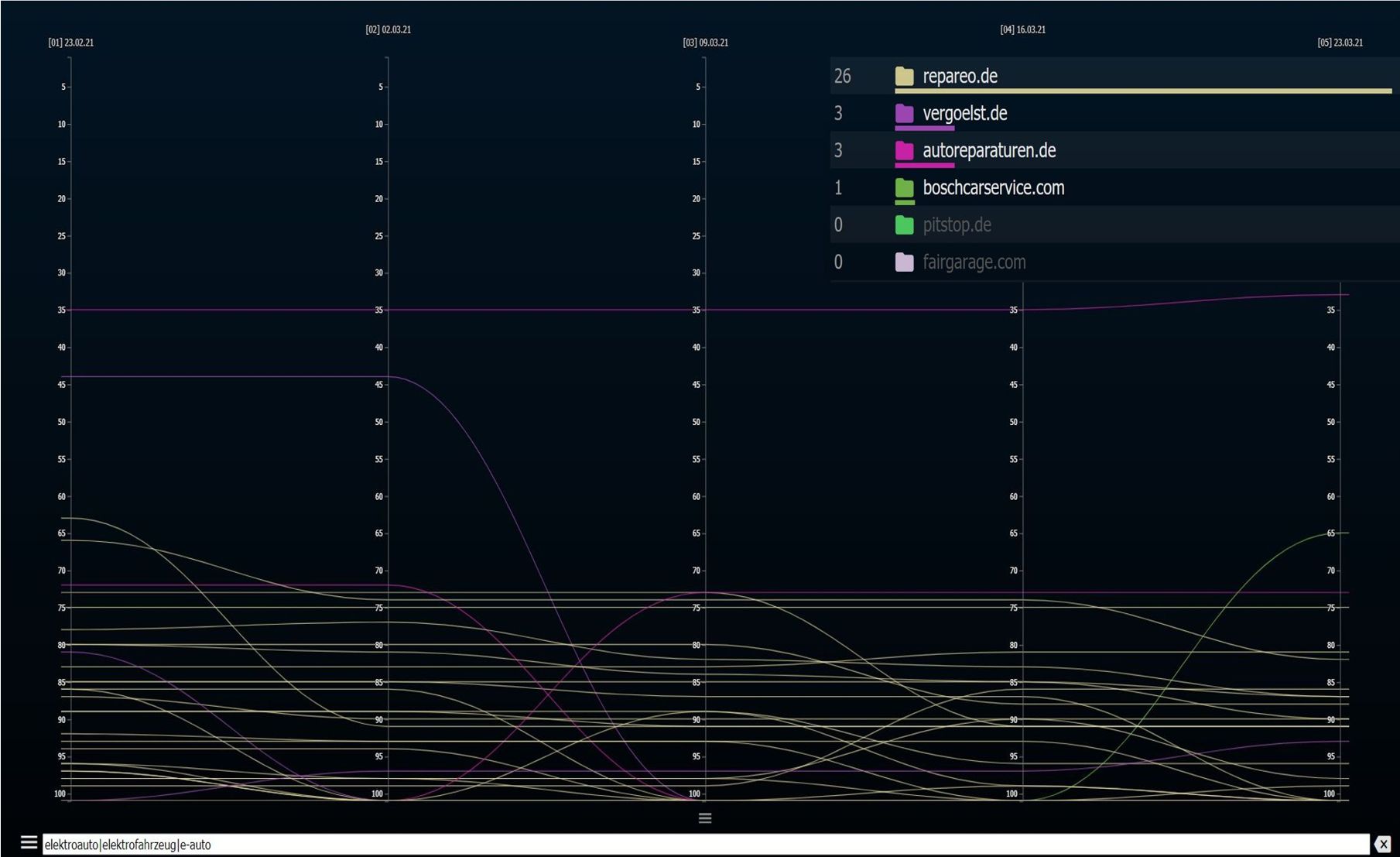

In the following, we will demonstrate this approach with an example. To do this, we will look at the offers (their websites) of six car repair shop portals, or chains (Autoreparaturen, Bosch Car Service, Fairgarage, Pitstop , Repareo and Vergoelst). The goal of these portals is, of course, to persuade the user to make an appointment with a garage. But what expectations (demand) do users have along the way? And who best fulfills (offers) these expectations?

First of all, this raises the question: how can Google help us with this analysis? In order to be able to answer a user question as well as possible, Google looks at the available offers (the web pages), categorizes them thematically, sorts them contextually (here mainly cars, repairs) and finally arranges them in terms of user acceptance (which offer is better accepted by the users?). This is how the familiar page of search results is created. And these “rankings” provide far more information than is apparent at first glance.

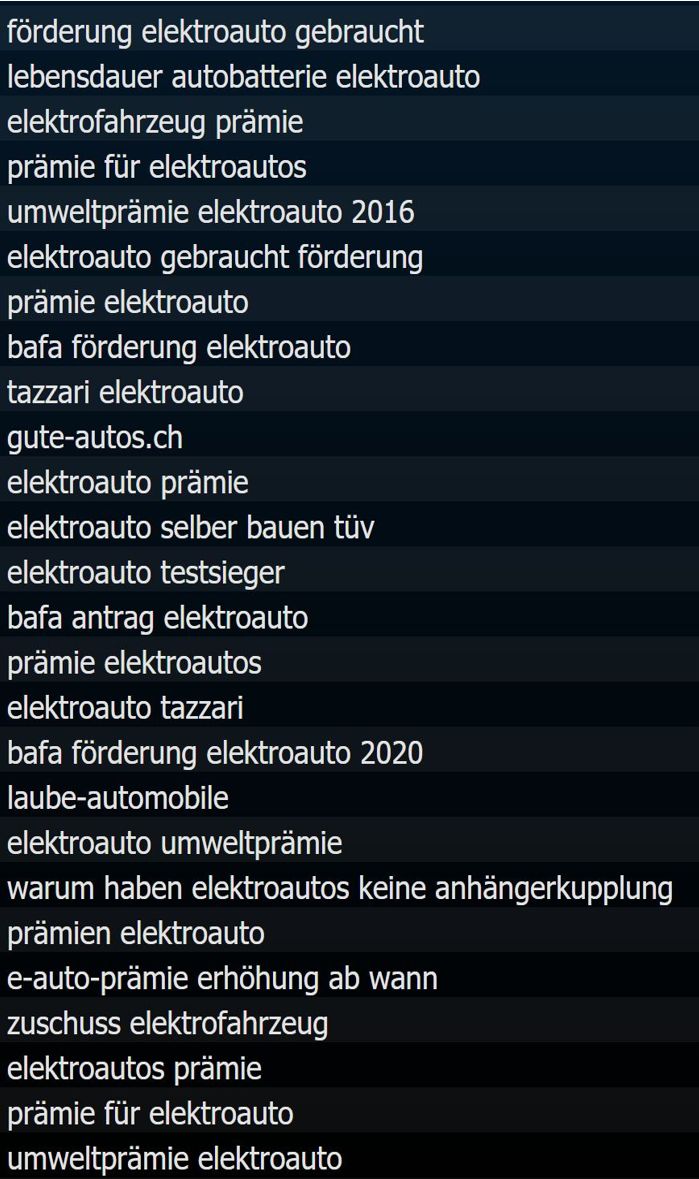

In our example, let’s start with the question of whether there are expectations in terms of brand loyalty. In the context of car repair shops, this brand loyalty does exist: